It’s a wrap! Future Branches brings together high-level retail banking professionals – primarily from operations, communications, IT, and design teams to discuss the leading strategies and technologies to improve the branch experience. We had an amazing time connecting with leading banking experts about business-critical challenges and technology that can drive the industry forward.

These are some of the top insights that we took away from the conference.

Today’s banking customers want more than lightning-fast access to their money. Whether visiting a neighborhood branch or using an app on their mobile phone, customers are looking for institutions they can trust. The best way to build that trust? A team of engaged and informed employees.

“In most industries, everybody is focused on the client first at the detriment to the team,” said Craig Felker, Assistant Vice President, Director of Client Experiences, Paducah Bank. Craig’s philosophy is that an exceptional client experience ultimately begins with creating an exceptional employee experience. “There isn’t a great resignation… there is a great alignment happening,” he says.

“We’ve shifted the last few years from understanding our members to understanding our staff,” said Heiwote Tadesse, EVP-Member Relations, Associated Credit Union. “Really invest in the conversations you could have with your staff. They are the most critical part of your bank or credit union.”

As the industry experiences major shifts in customer expectations and banking habits, banks have been reinventing their digital platform, brands, and branch environments. But actually executing those huge changes is extremely difficult.

At Future Branches, conversations are uncovering that what is getting in the way of actual execution is actually ineffective communication. When it comes to digital platforms, “we may have high customer adoption,” says Shaun McDougall, Head of Growth and Branch Administration, Branch Banking, Wells Fargo. “But internal communication in the organization is the challenge.” That’s why Wells Fargo prioritizes communications to re-engage the field. “We hear directly from our frontline,” says McDougall. “They actually know how to create systems that are better for their customers. Employee adoption is critical, first.”

Communication is the train that brings initiatives from headquarters into the branches where execution happens. If the track is broken, nothing gets to banks. Many industry leaders have been focused on solving their execution problem, but they are merely focusing on the symptom, not the cause, which is communication.

“Really invest in the conversations you could have with your staff. They are the most critical part of your bank or credit union,” says Heiwote Tadesse, EVP-Member Relations, Associated Credit Union.

Branch communication is key for execution, and it’s another crucial way to engage employees- which is especially important during the digital renaissance that banks are going through. Workers may feel threatened by the rise of self-serve technology or even replaced altogether. As communities reshape what a branch should offer, it leaves a lot of questions in the minds of employees, “The people leading these branches need to be recognized as they are trusted leaders in a noble profession,” says McDougall.

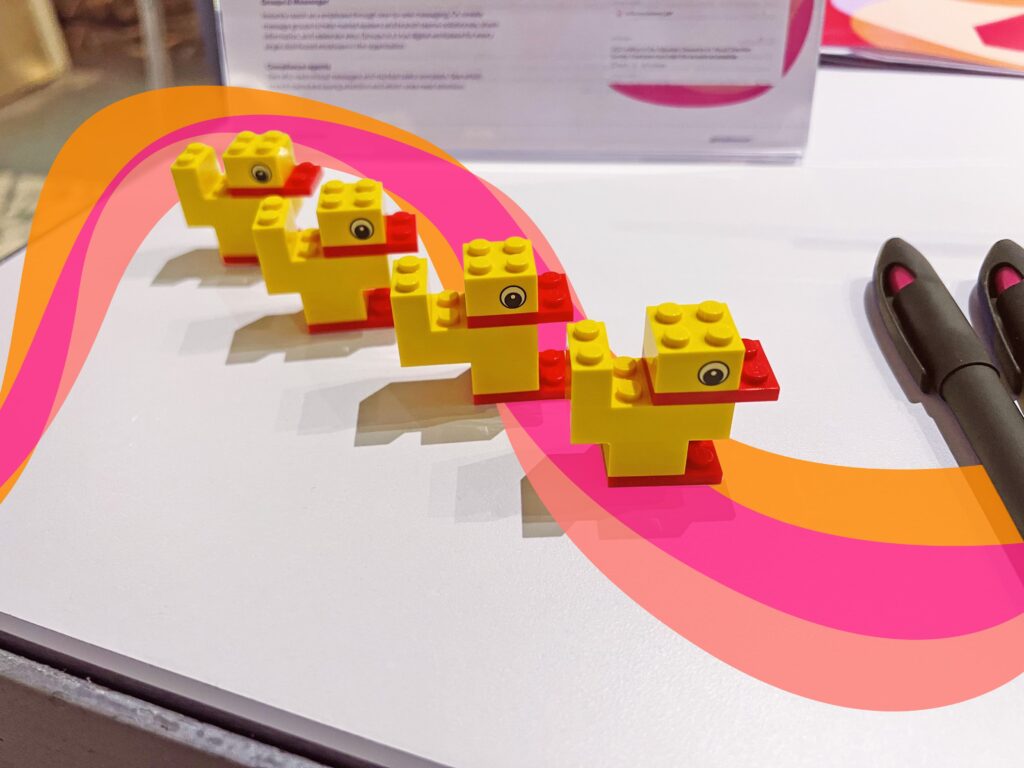

We came to Future Branches ready to work- and to play with LEGOs, of course. Have you ever done the “duck exercise?” We did it at a roundtable with our peers and colleagues! First, you get a pile of brightly colored plastic pieces, the instruction to build a duck, and 45 seconds to do it. There were some delightfully creative ducks on display- and very few looked alike. While supporting individual creativity is great, it’s not ideal for building a cohesive strategy across distributed teams.

It can be hard to show the impact and value of store communications. This exercise will help participants understand that communication can be interpreted in many ways and driving consistent brand execution requires a thoughtful approach, good process, and clear directions.

These ducks teach us an important lesson: clear communication makes a difference when it comes to consistent execution.

It’s the same principle with dispersed teams — if we don’t communicate correctly, they’ll fill in the gaps on their own and we won’t have consistent brand execution.

“How many of you rolled out an initiative in the last six months?” asked Zipline CTO and Co-founder, Jeremy Baker. Hands went up around the table. “How many of you checked up on your branches to follow up on those initiatives?” he asked? Again, all hands went up. “And how many of you saw 100% execution?” Not a single hand.

This tells us that just “sending out a message” won’t help us achieve our specific goals; what and how we communicate matters. Ultimately, communication is effective when it’s clear, concise, and actionable.

Future Branches was so much fun (and not because we got to play with LEGO Ducks)! But because we got to hear industry trailblazers share ideas and successes about the new technology that they are exploring in their branches. From ATMs to ITMs, we’re seeing banks roll out new self-service options for customers. And with internal buy-in, it is working! “It’s a journey and everyone has to be on the same page,” says Heiwote Tadesse, EVP-Member Relations, Associated Credit Union. “Buy-in, training, internal adoption, and consistency are crucial. Tell them the ‘why.’ We don’t roll out anything that the staff hasn’t tested or used, first.”

From biodegradable debit cards to crypto, banks are meeting Gen Z head-on, ready to embrace the newest generation of bankers and learn exactly what motivates them. (From staff to customers) “We need to start thinking differently,” says Craig Felker, Assistant Vice President, Director of Client Experiences, Paducah Bank. And not just with technology, but with getting talent engaged with tech. “Innovation is seeing change as an opportunity, not a threat.”

And this conversation isn’t just about technology, but about creating the inclusive workplace culture that the future demands. In every industry, workers and consumers are demanding that brands step up to the plate and become more responsible. “People are opting out of ‘toxic’ environments,” says Sandra Quince, Bank of America Leader on Loan as CEO, Paradigm for Parity. “We’re creating a level playing field so everyone feels in their org that they will be recognized and rewarded for the work they do.”

We know there’s a lot happening in banking these days, and branches can only do so much. That’s why we built Zipline – to make teams’ lives easier. Our all-in-one platform brings every facet of your branch’s business together in one personalized, prioritized platform, and it’s proven to drive better store execution and higher employee engagement.

📣 We’d love to hear about the store initiatives you have planned this year and, if you’re interested, share more about how Zipline can help. Schedule some time and let’s chat again soon.

Recent Posts

Company News

Zippy is Officially Here!

Retail Communications

Summer Camp 2024 Award Winners!

Company News

How To Convince Your Boss to Send You to Summer Camp

Employee Engagement

How Culture Fuels O’Reilly Auto Parts

Company News

Zipline Achieves Record-Breaking Customer Satisfaction Scores in 2023 Survey

Industry Trends

The Best Presentation I Saw at NRF Had Me Cheering By Myself in a Room Full of Strangers

Employee Engagement

Everything You Need to Know about Learning Journeys

Industry Trends

New Tech I Saw at NRF That May Be a Waste of Money

Expert Interviews

NRF 2024 Day 3

Industry Trends

NRF 2024 Day 2